CORPORATE GOVERNANCE OVERVIEW STATEMENT

The Board of the Directors of Country Heights Holdings Berhad (“CHHB” or “the Company”) acknowledges the importance of practicing

good corporate governance and is committed in maintaining high standards of corporate governance are practiced throughout the

Company and its subsidiaries (“the CHHB Group”), with integrity, transparency and professionalism to protect and enhance stakeholders’ value and the financial position of the CHHB Group.

The Board of Directors of CHHB (“the Board”) fully supports the principles and recommendations set out in the Malaysian Code of Corporate Governance 2017 (“the Code”), which was released on 26 April 2017 and is pleased to present the Corporate Governance (“CG”) Overview Statement based on the following three (3) principles:-

(i) Board leadership and effectiveness;

(ii) Effective audit and risk management; and

(iii) Integrity in corporate reporting and meaningful relationship with stakeholders.

This Statement is prepared in compliance with the Main Market Listing Requirements (“MMLR”) of Bursa Malaysia Securities Berhad (“Bursa Securities”) and it is to be read together with the CG Report 2018 of the Company which is available on the Company’s website at www.countryheights.com.my

PRINCIPLE A : BOARD LEADERSHIP AND EFFECTIVENESS

Responsibilities and Duties

The responsibilities of the Board of Directors of CHHB, amongst others, are to lead and establish the CHHB Group’s mission and vision and the provision of strategic directions for the long term success of the CHHB Group. CHHB’s Board comprises active and experienced Board members, with a mix of suitably qualified and experienced professionals in the fields of accountancy, banking and finance, property development and marketing, corporate finance and mergers and acquisitions.

The Board is responsible for setting the strategic directions of the CHHB Group and monitoring the implementation of those strategies by the Management, including:-

- oversight of the CHHB Group, including its control and accountability systems;

- appointing and removing the Group CEO;

- appointing and removing the Group CFO;

- appointing and removing the Company Secretary;

- Board and Executive Management development and succession planning;

- input into and final approval of corporate strategy;

- input into and final approval of the annual operating budget (including the capital management budget);

- approving and monitoring the progress of major capital expenditure, capital management and acquisitions/divestment;

- monitoring compliance with all relevant legal, tax and regulatory obligations;

- reviewing and monitoring systems of risk management and internal compliance and controls, codes of conduct, continuous disclosure, legal compliance and other significant corporate policies;

- at least annually, reviewing the effectiveness of CHHB’s implementation of its risk management system and internal control framework;

- monitoring Executive Management’s performance and implementation of strategy and policies, including assessing whether appropriate resources are available;

- approving and monitoring financial and other reporting to the market, shareholders, employees and other stakeholders; and

- appointment, reappointment or replacement of the external auditor.

- exercise care and diligence;

- act in good faith in the best interests of CHHB;

- not improperly use his/her position or misuse information of CHHB; and

- commit the time necessary to discharge effectively his/her role as a Director.

Executive Chairman and Group Chief Executive Officer

The Founder of CHHB, Tan Sri Lee Kim Tiong @ Lee Kim Yew (“Tan Sri Lee”), is the Executive Chairman of the Company. As Executive

Chairman, and given his capability, leadership and entrepreneurship skills, business acumen and his vast experience in the industry, Tan

Sri Lee undertakes to personally and passionately spearhead the CHHB Group to better performance in the near future together with the three (3) Executive Directors, each having separate and clearly defined scope of responsibility and authority. The division of roles and responsibilities ensures that there is no excessive concentration of power in these positions.

The Executive Chairman is responsible for ensuring Board effectiveness and conduct, leading the Board in the oversight of management.

The Executive Chairman also oversees the controls of the business through compliance and audit and the direction of the CHHB Group

business.

The Company has appointed Dato’ Low Kok Thai as the Group Chief Executive Officer (“the Group CEO”) with effect from 15 March 2019.

The Group CEO is responsible for the implementation of board policies approved by the Board and reports at Board Meetings all material

matters that potentially affect the CHHB Group and its performance, including strategic projects and regulatory developments.

Dato’ Low Kok Thai has been specifically appointed to carry out the following:-

- To reorganise the human resources structure with staff of “good character plus”, while the CHHB Group will be venturing back with properties, products, etc. for the high-end market;

- To reorganise and restructure the existing bank loans of RM130 million which are over-collateralised by 7 times with high chargeable interest rate;

- To implement blockchain, cryptocurrencies and big data technologies for the CHHB Group;

- To ensure all the vacant properties of the CHHB Group are leased out with a targeted rate of 80%;

- To be in-charged and manage the 5 Strategic Business Divisions (“SBVs”) of the CHHB Group; and

- To look for good strategic partners for the 5SBVs.

Company Secretary

The Board is supported by a suitably qualified and competent Company Secretary to provide sound governance advice, ensure adherence to rules and procedures and advocate adoption of corporate governance best practices. The Company Secretary is responsible to provide clear and professional advice to the Board on all governance matters, to ensure that Board procedures are followed, and the applicable rules and regulations for the conduct of the affairs of the Board are complied with. The Company Secretary attends and ensures that all meetings of the Board, Board Committees and Shareholders are properly convened, and that accurate and proper records of the proceedings and resolutions passed are taken and maintained in the statutory registers of the Company. The Board is regularly updated and apprised by the Company Secretary on new regulations issued by the regulatory authorities.

Supply of and Access to Information

The Directors have full and unrestricted access to complete information on a timely basis pertaining to the CHHB Group’s business and affairs to enable them to discharge their duties. Board Meetings which are scheduled to be held are also presented with relevant reports to facilitate its decision-making process. The Board and its Committees are given the notice and agenda of meetings at least seven (7) days in advance and the meeting papers are delivered at least three (3) days prior to each meeting.

The Directors have access to the advice and services of the Company Secretary. The Directors may seek advice from the Management

on matters relating to their areas of responsibility. The Directors may also interact directly with, or request further explanation, information or updates on any aspects of the Company’s operations or business concerns from the Management. The Directors may seek independent professional advice, at the Company’s expenses, if required, in furtherance of their duties.

All Board decisions are clearly recorded in the minutes, including the rationale for each decision, along with clear actions to be taken and the individuals responsible for their implementation. Relevant urgent Board decisions are communicated to the Management within one working day of the Board meeting and the minutes of Board Meetings are completed for comments by the Board members on a timely basis before the next succeeding Board meeting. Relevant extracts of the minutes are distributed to the Management for action once the board minutes are completed, depending on the urgency of the matters.

Board Charter

The Company has adopted a Board Charter which clearly defines the respective roles, responsibilities and authorities of the Board of Directors (both individually and collectively) and Management in setting the direction, the management and the control of the Company as well as matters reserved for the Board.

The Board Charter has been uploaded on the Company’s website at www.countryheights.com.my. The Board will review the Board Charter of the Company periodically and will update the Board Charter where appropriate, from time to time.

Code of Ethics for Directors

The Code of Ethics for Directors which was adopted by the Board supports the Company’s vision and core values by instilling, internalising and upholding the value of uncompromising integrity in the behaviour and conduct of the Directors.

The code is reviewed and updated regularly by the Board. The code has been uploaded on the Company’s website at

www.countryheights.com.my.

Whistleblowing Policy

An internal Whistleblowing Policy has been introduced for the employees to channel concerns about illegal, unethical or improper business conduct affecting the Company and about business improvement opportunities.

The Board and the Management gave their assurance that employees will not be at risk to any form of victimisation, retribution or retaliation from their superiors or any member of the Management provided they act in good faith in their reporting.

The Whistleblowing Policy has been uploaded on the Company’s website at www.countryheights.com.my.

Environmental & Sustainability Policy

The Board recognises the need to operate its business in a responsible and sustainable manner complying with all relevant legislative and regulatory requirements, to maintain its reputation, and to generate future business. CHHB combines its values of nature, love, quality, style and excellence, together with its vision of ‘Ever Searching for Better Living’ and set its commitment to sustainable good practice in the context of environment, economic and social consideration.

The Environmental & Sustainability Policy of the CHHB Group focuses on corporate sustainability in five main areas, being environment, health and safety, employees, business partners and local communities. The CHHB Group’s effort on environmental and social responsibility during the financial year are set out in the Sustainability Statement of this Annual Report.

The Environmental & Sustainability Policy has been uploaded on the Company’s website at www.countryheights.com.my.

Board Composition

As at the end of the financial year 2018, the Board comprised of eight (8) members, being four (4) Non-Executive Directors and four (4) Executive Directors. Of the four (4) Non-Executive Directors, three (3) are Independent, thus fulfilling the requirement that at least one-third (1/3) of the Board comprises of Independent Directors. A brief profile of each Director (except the profile of Encik Nik Hassan Bin Nik Mohd Amin who has resigned on 12 April 2019) is presented on pages 8 to 14 of this Annual Report.

The Board is led by a team of experienced members from different professional backgrounds, all of whom provide the CHHB Group with a wealth of professional expertise and experience which are conducive for efficient deliberations at Board meetings, giving rise to effective decision making and providing multi-faceted perspectives to the business operations of the CHHB Group.

Tenure of Independent Non-Executive Directors

The Board notes the Code’s recommendations in relation to the tenure of an Independent Director which shall not exceed a cumulative term of nine (9) years.

Mr Chew Chong Eu was appointed to the Board as Independent Non-Executive Director of the Company on 29 April 2008 and has,

therefore served for more than 9 years. Notwithstanding his long tenure in office, the Board, based on the review and recommendations made by the Nomination & Remuneration Committee, is unanimous in its opinion that the independency of Mr Chew Chong Eu has not been compromised or impaired based on the following justifications:

- He continues to fulfill the criteria and definition of an Independent Director as set out under Paragraph 1.01 of the MMLR;

- He has been with the Company for more than nine (9) years and therefore, understand the Company’s business operations which enable him to participate actively and contribute positively during deliberations or discussions at meetings of the Nomination & Remuneration Committee, the Audit & Risk Management Committee, and the Board; and

- He has contributed sufficient time and efforts at the meetings of the Nomination & Remuneration Committee, the Audit & Risk Management Committee, and the Board for informed and balanced decision making.

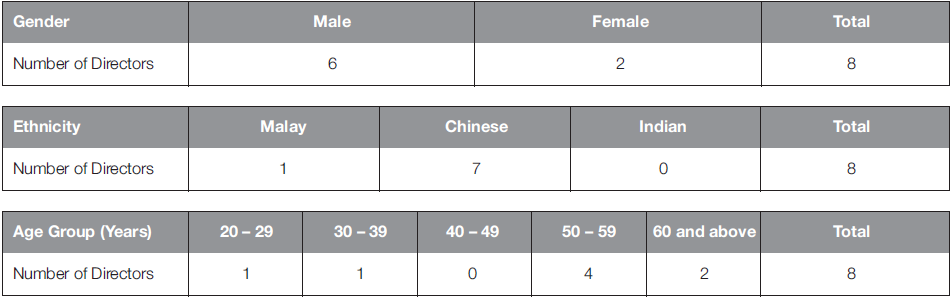

Board Diversity

The Board acknowledges the importance of boardroom diversity. Despite no specific targets being set in relation to boardroom diversity, the Board is committed to improving boardroom diversity in terms of gender, ethnicity, regional and industry experience, cultural and geographical background, age and perspective.

The Board is supportive of gender diversity in the boardroom as recommended by the Code and has developed a Gender Diversity Policy to promote the representation of women in the composition of the Board. For the purpose of the Code, the Gender Diversity Policy will refer principally to gender diversity in the boardroom, but this approach however, in no means limits the Company’s recognition and respect for the value of diversity at all levels of the organisation. A diverse boardroom and workplace include the skills and perspective that people bring to the organisation through, but not limited to, experience, gender, age, culture and beliefs. The Board will consider more female representation when suitable candidates are identified.

The Gender Diversity Policy has been uploaded on the Company’s website at www.countryheights.com.my.

As at 31 December 2018, the diversity of the Directors is as follows:-

|

Board Appointment

All nominees to the Board are first considered by the Nomination & Remuneration Committee, based on objective criteria, merit and with due regard for diversity in skills, experience, age, cultural background and gender before they are recommended to the Board. The Nomination & Remuneration Committee may also consider the use of external consultants in the identification of potential directors.

While the Board is responsible for the appointment of new Directors, the Nomination & Remuneration Committee is delegated the role of screening and conducting an initial selection before making a recommendation to the Board.

Re-election/Re-appointment of Directors

The Constitution (Articles of Association) of the Company requires a director appointed during a financial year to retire at the following annual general meeting. All directors are bound to retire at least once in every three (3) years and re-election of directors takes place at each Annual General Meeting (“AGM”). All retiring directors shall be eligible for re-election/re-appointment.

The re-election/re-appointment of directors at the AGM are subject to prior assessment by the Nomination & Remuneration Committee and the recommendations thereafter are submitted to the Board and then for shareholders’ approval.

The re-election/re-appointment of directors ensured that shareholders have a regular opportunity to reassess the composition of the Board.

Board Meetings

The Board is satisfied with the level of commitment given by the Directors towards fulfilling their roles and responsibilities as Directors of CHHB. All the Directors have complied with the minimum requirements on attendance at Board Meetings as stipulated in the MMLR of Bursa Securities (minimum 50%).

During the financial year, the Board held seven (7) meetings and details of Directors’ attendances are set out below. Besides the Board Meetings, urgent decisions were approved via Directors’ Circular Resolutions during the year.

| Name of Director | No. of Meetings Attended |

| Tan Sri Lee Kim Tiong @ Lee Kim Yew (Executive Chairman) |

6/7 |

| Lee Cheng Wen (Deputy Chairman, Non-Independent Non-Executive Director) |

5/7 |

| Chew Chong Eu (Independent Non-Executive Director) |

7/7 |

| Ong Tee Chin (Independent Non-Executive Director) |

|

| Lee Thai Young Matahari (Executive Director) |

6/7 |

| Lee Sow Lin (Executive Director) |

6/7 |

| Yip Chun Mun (Executive Director) |

6/7 |

| Nik Hassan Bin Nik Mohd Amin (Independent Non-Executive Director) Resigned on 12 April 2019 |

7/7 |

| Har Soon Thim (Executive Director) Resigned on 22 October 2018 |

5/5 |

At Board meetings, the Chairman encourages constructive, healthy debate, and the Directors are free to express their views. Any Director who has a direct and/or deemed interest in the subject matter to be deliberated shall abstain from deliberation and voting on the same during the meeting.

Directors’ Training

The Directors are also encouraged to attend seminars/courses from time to time to equip themselves with the necessary knowledge to discharge their duties and responsibilities more effectively.

During the financial year, the Directors have attended, individually and/or collectively, various programmes, amongst others, as follows:-

| Name of Directors | Training Programmes |

| Tan Sri Lee Kim Tiong @ Lee Kim Yew | • Pitch@Palace Commonwealth Boot Camp • Pitch@Palace Commonwealth • 11th Commonwealth Business Forum • World Chinese Economic Summit Regional Roundtable • Muslim-Confucian Dialogue Forum • The International Confucianism Entrepreneurship Forum • World Chinese Economic Forum • World Peace Forum • ASEAN Disruptive Leadership Summit |

| Lee Cheng Wen | • Corporate Governance Briefing Session • ASEAN Disruptive Leadership Summit |

| Chew Chong Eu | • China's Belt & Road Initiative: Impact on Malaysian Capital Market • Kampuchea Institute of Certified Public Accountants & Auditors & Grant Thornton (Cambodia) Limited • Auditing, Assurance & Risk Management |

| Ong Tee Chin | • Non-Financials – Does It Matter? • Technical Analysis Series : How to Perform Successful Trades with Simple and Effective Technical Analysis • AMLA, Financial Services & Prevention of Market Misconduct in Digital Economy |

| Lee Thai Young Matahari | • ASEAN Disruptive Leadership Summit |

| Lee Sow Lin | • M&A Outlook in an Election Year |

| Yip Chun Mun | • ASEAN Disruptive Leadership Summit |

The Company will continuously arrange further training for the Directors as part of their obligations to update and enhance their skills and knowledge which are important for carrying out an effective role as Directors. From time to time, the Board also receives updates and briefings, particularly on regulatory and legal developments relevant to the Company’s business.

Board Committees

The Board has delegated specific responsibilities to two (2) board committees, being the Audit & Risk Management Committee and Nomination & Remuneration Committee. The delegation of certain responsibilities of the Board to its Committees is necessary as there is now greater reliance on the Board Committees in response to the complex challenges of the business.

These Committees have the authority to examine particular issues within their terms of reference and report back to the Board with their recommendations. The ultimate responsibility for the final decision on most matters remains with the entire Board.

All Board Committees have written terms of reference, operating procedures and authority delegated and approved by the Board, which are reviewed from time to time to ensure they are relevant and up-to-date.

The Chairpersons of the various Board Committees report the outcome of their meetings to the Board and relevant decisions are

incorporated into the minutes of the meetings of the Board of Directors.

Audit & Risk Management Committee (“ARMC”)

The report of the ARMC is set out on pages 53 to 57 of this Annual Report.

Nomination & Remuneration Committee (“NRC”)

The NRC comprises wholly of Non-Executive Directors, majority of whom are independent.

The terms of reference of the NRC is available on the Company’s website at www.countryheights.com.my.

Membership

• Chew Chong Eu (Chairman of NRC);

• Nik Hassan Bin Nik Mohd Amin - resigned on 12 April 2019;

• Ong Tee Chin; and

• Lee Cheng Wen.

Objectives

The objectives of the NRC with regard to the nomination role are as follows:-

- to identify and recommend new nominees to the Board as well as the Board Committees, however all decision as to who shall be appointed shall be the responsibility of the Board after considering the recommendations of the NRC;

- to assist the Board in reviewing the Board’s required mix of skills, experience and other qualities, including core competencies which both Executive and Non-Executive Directors should bring to the Board;

- to implement the process formulated by the Board designed to assess the effectiveness of the Board and the Board Committee as a whole;

- to develop policies, practice and recommend proposals appropriate to facilitate the recruitment, retention and removal of Executive Director as well as the length of service; and

- to review the Executive Directors’ objectives, goals and the assessment of performance.

The objectives of the NRC with regard to the remuneration role are as follows:-

- to determine the level and make-up of Executive Directors’ remuneration so as to ensure that CHHB attracts and retains the Directors of the appropriate calibre, experience and quality needed to run the CHHB Group successfully. The level and make-up of the remuneration should be structured so as to link rewards with corporate and individual performance; and

- to determine the remuneration packages of Non-Executive Directors which shall be a decision of the Board as a whole.

Authority

The NRC is authorised by the Board:-

- to seek assistance from the Company Secretary on matters related to the responsibilities of the NRC under the rules and regulations to which it is subject to and how those responsibilities should be discharged;

- to have full and unrestricted access to the Company’s records, properties and personnel; and

- to seek independent professional advice and expertise deemed necessary for the performance of its duties.

The responsibilities in relation to nomination matters are as follows:-

- to formulate the nomination, selection and succession policies for the Board and Board Committees as may be determined by the NRC from time to time;

- to make recommendations to the Board on new candidates for election/appointment, and re-election/re-appointment of the Directors to the Board;

- to make recommendations to the Board for appointment to fill casual vacancies;

- to conduct a review in determining whether a director can continue to be independent in character and judgement, and also to take into account the need for progressive refreshing of the Board; and

- to review the required mix skills, experience and other qualities of the Board annually.

The responsibilities in relation to remuneration matters are as follows:-

- to formulate and/or review the remuneration policies and packages for the members of the Board and Board Committees and recommend to the Board for approval; and

- to approve the utilisation of the provision for annual salary increment, performance bonus and long term incentives (if any) in respect of each financial year.

The NRC shall consider any other matters referred by the Board to the NRC and, in discharging its duties, the NRC shall at all times be mindful of the provisions of all applicable laws, regulations and guidelines.

Meeting Attendance of the NRC

The NRC met once during the financial year.

Main Activities of the NRC in 2018

During the year, the NRC has fulfilled a number of key activities, as listed below:-

- evaluated and assessed the performance of the Independent Non-Executive Directors (self-assessment) for the year 2017.

- evaluated and assessed the performance and effectiveness of the Board of Directors and Board Committees for the year 2017.

- reviewed and recommended the re-election of Director due for retirement pursuant to Articles 102 and 106 of the Constitution (Articles of Association) of the Company, at the 34th Annual General Meeting.

- reviewed and recommended the retention of the Independent Directors who had served the Board for more than 9 years.

- reviewed the remuneration of the Directors for the year 2018 and subsequently recommended to the Board for approval.

Directors’ Remuneration

The policy and framework for the overall remuneration of the Executive and Non-Executive Directors are reviewed regularly against market

practices by the Nomination & Remuneration Committee, following which recommendations are submitted to the Board for approval.

The Board as a whole determines the remuneration of the Directors and each individual Director abstains from the Board decision on his

own remuneration.

The remuneration of Non-Executive Directors is based on a standard fixed fee. In addition, allowances are also paid in accordance with

the number of meetings attended during the year.

The Executive Directors are not entitled to the above Directors’ fee nor are they entitled to receive any meeting allowance for Board or

Board Committee meetings that he/she attends. Their remuneration is based on their Key Performance Indicators (“KPIs”) which are

appraised annually.

Disclosure of each Director’s remuneration is set out under Practice 7.1 in the Corporate Governance Report.

The proposed Directors’ fees for the financial year 2018 will be tabled at the forthcoming 35th AGM for shareholders’ approval.

The remuneration of the Directors (including Encik Nik Hassan Bin Nik Mohd Amin and Mr Har Soon Thim prior to their resignations) for

the financial year ended 31 December 2018 is as follows:

| Description | Executive Directors RM’000 |

Non-Executive Directors RM’000 |

Total RM’000 |

| Salaries & Other emoluments | 1,010 | 49 | 1,059 |

| Benefit-in-kinds | 30 | - | 30 |

| EPF Contribution | 138 | - | 138 |

| Fees/td> | - | 56 | 56 |

| Total | 1,178 | 105 | 1,283 |

The number of Directors (including Encik Nik Hassan Bin Nik Mohd Amin and Mr Har Soon Thim prior to their resignations) whose total remuneration falls into the respective bands is as follows:-

| Number of Directors |

||

| Range of Remuneration (RM) | Executive |

Non-Executive |

| Up to RM100,000 | 2 | 4 |

| RM100,001 to RM200,000 | 1 | - |

| RM200,001 to RM300,000 | - | - |

| RM300,001 to RM400,000 | - | - |

| RM400,001 to RM500,000 | 1 | - |

| RM500,001 to RM600,000 | 1 | - |

PRINCIPLE B : EFFECTIVE AUDIT AND RISK MANAGEMENT

Audit & Risk Management Committee (“ARMC”)

The ARMC comprises wholly of Non-Executive Directors, majority of whom are independent

The terms of reference of the ARMC is available on the Company’s website at www.countryheights.com.my.

Membership

• Ong Tee Chin (Chairman of ARMC);

• Nik Hassan Bin Nik Mohd Amin - resigned on 12 April 2019;

• Chew Chong Eu; and

• Lee Cheng Wen.

The composition of the ARMC is in compliance with Paragraphs 15.09 and 15.10 of the MMLR. None of the members of the ARMC were

former key audit partners and notwithstanding that, in order to uphold the utmost independence, the Board has no intention to appoint any

former key audit partner as a member of the ARMC.

The Board regards the members of the ARMC to collectively possess the accounting and related financial and risk management expertise

and experience required to discharge its responsibilities and assist the Board in its oversight over the financial reporting process. The ARMC

assists the Board in reviewing and scrutinising the information in terms of the appropriateness, accuracy and completeness of disclosure and

in ensuring that the CHHB Group’s financial statements comply with applicable financial reporting standards. The ARMC reviews and monitors

the accuracy and integrity of the CHHB Group’s quarterly and annual financial statements and submits these statements to the Board for

approval and release within the stipulated time frame.

The responsibilities of the ARMC are guided by its terms of reference, which is available at the Company’s website at

www.countryheights.com.my.

Relationship with Auditors

The Board, by the establishment of the ARMC, maintains a formal and transparent relationship with the CHHB Group’s auditors. The

external auditors are invited to participate and brief the ARMC on specific issues at ARMC meetings. The roles of both the external and

internal auditors are further described in the Audit & Risk Management Committee Report.

The CHHB Group has established an in-house Group Internal Audit Department, in addition to utilising the services of the external auditors,

which reports significant findings directly to the ARMC with recommended corrective actions. The Management is responsible to ensure

that corrective actions on reported weaknesses are undertaken within an appropriate timeframe.

The ARMC and the Board maintain great emphasis on the objectivity and independence of the Auditors, namely Messrs. UHY, in providing

relevant and transparent reports to the shareholders. As a measure of ensuring full disclosure of matters, the Auditors are invited to attend

the ARMC meetings for discussion with the ARMC without the presence of the Management, as well as the AGM.

Risk Management and Internal Controls

The Board recognises and affirms its overall responsibility for the CHHB Group’s system of internal controls, which includes the

establishment of an appropriate control environment and control framework as well as for reviewing its effectiveness, adequacy and integrity.

The Board acknowledges that this system is designed to manage, rather than eliminate the risk of non-achievement of the CHHB Group’s

objectives.

The Board has overall responsibility for maintaining sound internal control systems that cover financial controls, operational and compliance

controls and risk management to ensure shareholders’ investments, customers’ interest and the CHHB Group’s assets are safeguarded.

The Statement on Risk Management and Internal Control as set out on pages 58 to 60 of this Annual Report provides an overview of the

state of internal controls within the CHHB Group.

PRINCIPLE C : INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH STAKEHOLDERS

Communication with Shareholders and Investors

The Board values the support of its shareholders and investors. It also recognises the importance of effective communication with the

shareholders and the investment community of material corporate and business matters of the CHHB Group. Its commitment, both in

principle and practice, is to maximise transparency consistent with good corporate governance, except where commercial confidentiality

dictates otherwise.

In complying with Paragraph 9.21(3) of the MMLR to improve investor relations between the Company and its stakeholders, CHHB ensures

that its website contains the email address(es) of the designated person(s) and contact numbers to enable the public to forward queries

to the Company. CHHB also post announcements made to Bursa Securities on its website immediately after such announcements are

released on Bursa Securities’ website.

Conduct of General Meetings

The Annual Report is an important medium of information for the shareholders and investors whereas the Annual General Meeting (“AGM”)

provides a vital platform for both private and institutional shareholders to share their views and acquire information on issues relevant to

the CHHB Group.

In an effort to save costs and encourage shareholders to benefit from Information and Communication Technology, CHHB continues to

dispatch annual reports to the shareholders in electronic format (CD-ROM). However, shareholders are given the option to request for

hard copies of the Annual Report.

Notice of AGM is sent out to the shareholders in the month of April with more than the required twenty-eight (28) days’ notice before the

date of the AGM, which is usually held in June. This would enable the shareholders ample time to make the necessary arrangement to

attend and participate in person or by corporate representatives, proxies or attorneys.

Shareholders and members of the public can access the Company’s website at www.countryheights.com.my for the latest information on

the CHHB Group.

At the AGM, the Chairman presents a comprehensive review of the CHHB Group’s financial performance and value created for the

shareholders as well as current developments of the CHHB Group. The AGM is the principal forum for dialogue with the shareholders. It

provides shareholders and investors with an opportunity to seek clarification on the CHHB Group’s business strategy, performance and

major developments. All Directors of CHHB, including the Chairman of the ARMC and NRC, Senior Management and the External Auditors

will attend the AGM to provide meaningful response to questions addressed.

Poll Voting

In line with Paragraph 8.29A of the MMLR that any resolution set out in the notice of any general meeting, or in any notice of resolution

which may properly be moved and is intended to be moved at any general meeting, is voted by poll, the Board shall table all the resolutions

at the forthcoming AGM for voting by poll.

COMPLIANCE STATEMENT

The Board is supportive of all the recommendations of the Code and has ensured that these recommendations as set out in the Code

have been substantially implemented accordingly by the CHHB Group. The Board will take reasonable steps to review existing policies

and procedures from time to time to ensure full compliance thereof.

ADDITIONAL COMPLIANCE INFORMATION

Material Contracts

Material contracts of the Company and its subsidiaries involving Directors and substantial shareholders either subsisting at the end of the

financial year or entered into since the end of the previous financial year are disclosed in the Financial Statements.

Contracts Relating To Loan

There were no contracts relating to any loan by the Company in respect of the above said item.

Related Party Transactions

Significant related party transactions of the CHHB Group are disclosed in the Financial Statements.

Audit and Non-Audit Fees

The amount of audit and non-audit fees incurred by the CHHB Group for the financial year ended 31 December 2018 is disclosed in the

Financial Statements.

Share Buy-Back

The existing authority for the Company to purchase up to 10% of its total number of issued shares capital shall expire at the conclusion

of the forthcoming AGM and is subject to renewal by the shareholders at the said AGM.

There was no share buy-back during the financial year ended 31 December 2018.

Details of the shares purchased, as at to-date are set out below:-

| Month | No. of shares purchased and retained as treasury shares |

Lowest price paid per share (RM) |

Highest price paid per share (RM) |

Average price paid per share (RM) |

Total consideration *(RM) |

| June 2014 | 100,000 | 1.44 | 1.50 | 1.47 | 147,430.08 |

| June 2015 | 2,050,000 | 1.32 | 1.35 | 1.35 | 2,777,170.98 |

* Inclusive of transaction cost

All the shares purchased by the Company were retained as treasury shares as at 31 December 2018. There was no resale of any treasury share during the financial year.

Utilisation of Proceeds

The Company did not raise any proceeds from corporate proposals during the financial year ended 31 December 2018.

This Statement is made in accordance with the resolution of the Board of Directors duly passed on 12 April 2019.

AUDIT & RISK MANAGEMENT COMMITTEE REPORT

The Audit & Risk Management Committee (“ARMC”) of Country Heights Holdings Berhad was established with the objective of assisting

the Board of Directors in the areas of corporate governance, system of internal controls, risk management and financial reporting of the

Group. Members of the ARMC are mindful of their dual roles which are clearly reflected and demarcated in the agendas of each meeting.

COMPOSITION

The Committee comprises four (4) members all of whom are Non-Executive Directors, with a majority of them being independent Directors.

This meets the requirement of Paragraph 15.09(1)(2) of the Bursa Malaysia Listing Requirements (Listing Requirements).

The Committee consists of the following members:

| Name of Director | Designation | Directorship |

| Ong Tee Chin | Chairman (Re-designated as ARMC Chairman on 12 April 2019) |

Independent Non-Executive Director |

| Nik Hassan Bin Nik Mohd Amin | Chairman (Resigned on 12 April 2019) |

Independent Non-Executive Director |

| Chew Chong Eu | Member | Independent Non-Executive Director |

| Lee Cheng Wen | Member | Non-Independent Non-Executive Director |

ATTENDANCE OF MEETING

The ARMC met five (5) times during the financial year ended 31 December 2018. The attendances of the ARMC members for the five (5) meetings are as follows:

| Name | Attendance | % |

| Nik Hassan Bin Nik Mohd Amin | 5/5 | 100% |

| Chew Chong Eu | 5/5 | 100% |

| Lee Cheng Wen | 4/5 | 80% |

| Ong Tee Chin | 5/5 | 100% |

The Executive Chairman, Executive Directors, Chief Financial Officer Group Finance, other Senior Management members and the external auditors attended these meetings upon invitation to brief the ARMC on specific issues.

Prior to some ARMC meetings, private sessions were held between the Chairman ARMC and external auditors without the Management’s presence.

Minutes of meetings of the ARMC were circulated to all members and significant matters reserved for the Board’s approval were tabled at the Board meetings. The Chairman of the ARMC provides a report on the decisions and recommendations of the ARMC to CHHB Board.

TERMS OF REFERENCE

The ARMC has reviewed and endorsed its Terms of Reference to be in line with the Main Market Listing Requirements (“MMLR”) of Bursa

Malaysia Securities Berhad (“Bursa Securities”) and best practices propagated by Bursa Securities Corporate Governance Guide; towards

Boardroom Excellence.

Composition

The ARMC shall be appointed by the Board from amongst the Directors of the Company and shall consist of not less than 3 members of

whom the majority shall be independent directors. All members of the ARMC shall be non-executive directors.

All members of the ARMC shall be financially literate and at least one member of the ARMC:-

i) must be a member of the Malaysian Institute of Accountants; or

ii) if he is not a member of the Malaysian Institute of Accountants, he must have at least three years working experience and;

(a) he must have passed the examinations specified in Part I of the 1st Schedule of the Accountants Act 1967;

(b) he must be a member of one of the associations of accountants specified in Part II of the 1st Schedule of the Accountants Act

1967; or

(c) Fulfils such other requirements as prescribed or approved by the Bursa Malaysia Securities Berhad.

No alternate Director shall be appointed as a member of the ARMC. The members of the ARMC shall elect a Chairman from among their

members who shall be an independent non-executive director. In the absence of the Chairman and/or an appointed deputy, the remaining

members present shall elect one of themselves to chair the meeting.

Appointments to the ARMC shall be for a period of up to three (3) years, which may be extended further periods of up to three (3) years,

provided the director still meets the criteria for membership of the ARMC.

In the event of any vacancy in the ARMC resulting in the non-compliance with sub-paragraph 15.09(1) of the MMLR, the Company must

fill the vacancy within three (3) months.

Quorum

The quorum shall not be less than 2, the majority of whom shall be independent directors.

Attendance & Frequency of Meetings

The ARMC shall meet as the Chairman deems necessary but not less than 4 times a year. The Chairman shall be entitled where deemed

appropriate to invite any person(s) to meetings of the ARMC.

The ARMC shall meet with the external auditors, internal auditors or both, without executive board members and employees present at

least twice a year.

Authority

The ARMC is authorized by the Board to:-

i) Seek any information relevant to its activities from employees of the Company.

ii) source for necessary resources required to carry out its duties.

iii) obtain independent professional advice it considers necessary.

iv) have full and unlimited access to any information and documents pertaining to the Company.

v) investigate any matters within its terms of reference, with explicit authority.

Functions

i) Financial Statements, External Audit and Other Information

The duties of the ARMC shall be to:-

(a) make appropriate recommendations to the Board on matters pertaining to the nomination, appointment and dismissal of external

auditors and the fee thereof;

(b) review and discuss with the external auditors and internal auditors before the commencement of audit, the nature and scope of

the audit;

(c) review the quarterly and year-end financial statements of the Group and Company prior to submission to the Board, focusing

particularly on:-

- public announcement of results and dividend payments;

- any significant changes in accounting policies and practices;

- significant adjustments and unusual events resulting from the audit;

- the going concern assumption;

- compliance with stock exchange, accounting standards and legal requirements.

(e) review external auditors’ letter to management (if any) and management’s response;

(f) review the adequacy of the scope, functions, competency and resources of the internal audit function and that it has the necessary authority to carry out its work;

(g) review the internal audit planning memorandum and results of the internal audit process and where necessary, ensure that appropriate action is taken on the recommendations of the internal audit function;

(h) review any appraisal or assessment of the performance of the Head of the internal audit function;

(i) approve any appointment or dismissal of the Head of the internal audit function;

(j) inform itself of resignation of the Head of internal audit and provide him/her an opportunity to submit reason(s) for resigning;

(k) consider any related party transactions and conflict of interest situation that may arise within the Company or Group that may raise questions over management’s integrity;

(l) consider the findings of internal audit investigations and management’s response;

ii) Risk Management, Internal Control and Information Systems

The ARMC will review and obtain reasonable assurance that the risk management, internal control and information systems are operating effectively to produce accurate, appropriate and timely management and financial information. This includes the following:-

(a) advise the board on the Group’s overall risk appetite, tolerance and strategy, taking account of the current and prospective macroeconomic and financial environment drawing on financial stability assessments and other authoritative sources that may be relevant for the Group’s risk policies;

(b) champion and promote the Enterprise Risk Management and to ensure that the risk management process and culture are embedded throughout the Group;

(c) provide routine monthly and quarterly reporting and update the Board on key risk management issues and Potential Loss Event;

(d) review Risk Management Framework and Policy & Guide annually;

(e) oversee and advise the board on the current risk exposures of the Group and future risk strategy to ensure development and growth of the Group on a sustainable basis;

(f) in relation to risk assessment:-

- keep under review the Group’s overall risk assessment processes that inform the board’s decision making, ensuring both qualitative and quantitative metrics are used;

- review regularly and approve the parameters used in these measures and the methodology adopted;

- set a standard for the accurate and timely monitoring of large exposures and certain risk types of critical importance, and

- consider whether the Group has effective management systems in place to identify, assess, monitor and manage its key risk areas.

(h) review reports on any material breaches of risk limits and the adequacy of proposed action;

(i) follow-up on management action plans based on the status of implementation compiled by the management;

(j) review the Business Risk Analysis & Evaluation and Mitigation Plans to be escalated to the Board on an annual basis and to report any major breach of Risk policies and tolerance limits and ensure Risk Mitigants are in place;

(k) give a view on proposal/feasibility studies prepared by project sponsor or project consultants which meet the requisite threshold before recommending to the Board for final decision;

(l) keep under review the effectiveness of the Group’s internal financial controls and internal controls and risk management systems and review and approve the statements to be included in the annual report concerning internal controls and risk management;

(m) review the Group’s procedures for preventing fraud; and

(n) consider and approve the remit of the risk management function and ensure it has adequate resources and appropriate access to information to enable it to perform its function effectively and in accordance with the relevant professional standards.

The ARMC shall also ensure the function has adequate independence and is free from management or other restrictions.

Minutes

The Secretary shall cause minutes to be duly entered in the books provided for the purpose of all resolutions and proceedings of all

meetings of the ARMC. Such minutes shall be signed by the Chairman of the meeting at which the proceedings were held or by the

Chairman of the next succeeding meeting and if so signed, shall be conclusive evidence without any further proof of the facts thereon

stated. Minutes of each meeting shall also be distributed to the members of the ARMC prior to each meeting.

Summary of Activities of the ARMC

During the financial year, the ARMC carried out its duties as set out in its Terms of Reference, including but not limited to:-

i) review of audit plans prepared by both internal and external auditors;

ii) review of unaudited quarterly financial statements during the financial year prior to submission to the Board for consideration and

approval, the review and discussion were conducted with the Group Chief Financial Officer;

iii) review and evaluate the policies for risk management and systems of internal control;

iv) review of internal audit reports presented by internal auditors and consider the major findings by the internal auditors and management’s

responses thereto;

v) review of the audited financial statements for the financial year ended 31 December 2018 and to discuss significant audit issues and

findings with the external auditors;

vi) review the procedures for identification of related party transactions for compliance with the Listing Requirements of Bursa Securities

and the appropriateness of such transaction, if any, before recommending to the Board for approval; and

vii) meet and discuss with the external auditors without the presence of the management staff.

External Audit

a. The External Auditors’ presented the Interim Report for the financial year ended 31 December 2017 at its meeting on 27 February

2018 with regard to the relevant disclosures in the annual audited financial statements. The ARMC also considered suggestions to

improve the accounting procedures and internal control measures.

b. On 19 April 2018, the External Auditor tabled the Final Report and the Audit Financial Statements for the year ended 31 December

2017.

c. On 24 May 2018, the Group Finance tabled the proposal on the appointment of the new External Auditors Messrs. UHY of CHHB

and its Group of companies in place of the retiring Auditors, Messrs. Kreston John & Gan.

d. On 26 November 2018, the ARMC reviewed the External Auditors’ Professional Services Planning Memorandum for the financial year

ending 31 December 2018 outlining their scope of work and proposed fees of RM297,000 for the statutory audit and review of the

Statement on Internal Control for 2018. The ARMC further resolved to recommend the proposed fees to the Board for approval.

e. The new standard in the By-Laws (On Professional Ethics, Conduct and Practice) for Professional Accountants requires External

Auditors to communicate in writing to the ARMC all breaches of independence requirements of the IEBSA Code of Ethics.

Summary of Activities of the Internal Audit Function

The ARMC is aware of the fact that an independent and adequately resourced internal audit function is essential to assist in obtaining the

assurance it requires regarding the effectiveness of the system of internal controls.

The internal audit function is undertaken by an in-house internal audit department. The internal audit function reports independently to the

ARMC and its role encompasses the examination and evaluation of the adequacy and effectiveness of the Group’s system of internal

controls to provide reasonable assurance to the members of the ARMC. During the financial year under review the GIAD operated with

the total manpower of 2 staff and both of them were also free from any relationship or conflicts of interest.

The internal audit function performs internal audits with strict adherence to the Professional Practices Framework of The Institute of Internal

Auditors, USA (“IIA”) and conformance with the IIA’s International Standards for The Professional Practice of Internal Auditing (“Standards”)

in meeting the responsibilities of internal auditors and the internal audit activity.

The purpose of the Standards is to:

1. Delineate basic principles that represent the practice of internal auditing.

2. Provide a framework for performing and promoting a broad range of value-added internal auditing.

3. Establish the basis for the evaluation of internal audit performance.

4. Foster improved organisational processes and operations.

The Standards are principles-focused, mandatory requirements consisting of:

- Statements of basic requirements for the professional practice of internal auditing and for evaluating the effectiveness of performance, which are internationally applicable at organisational and individual levels.

- Interpretations, which clarify terms or concepts within the Statements.

The internal audit activities carried out, under a risk-based approach, for the financial year include, inter alia, the following:-

i) formulated annual risk-based audit plan and reviewed the resource requirements for audit executions;

ii) executed internal audit reviews in accordance with the approved annual audit plan;

iii) issued reports on the internal audit findings identifying weaknesses and highlighting recommendations for improvements on a periodic basis;

iv) followed-up on the implementation of corrective action plans or best practices agreed with management; and

v) attended ARMC meetings to table and discuss the audit reports and followed up on matters raised.

The internal audit reviews conducted did not reveal weaknesses that have resulted in material losses, contingencies or uncertainties that would require separate disclosure in the annual report.

The total cost incurred for the internal audit function of the Group for the financial year ended 31 December 2018 was RM188,800.

STATEMENT ON RISK MANAGEMENT AND INTERNAL CONTROL

Responsibility and Accountability

The Board of Country Heights Holdings Berhad affirms its overall responsibility for the Group’s system of internal controls to safeguard shareholders’ investments and the assets of the Group as well as reviewing the adequacy, integrity and effectiveness of the system. Internal control systems are primarily designed to cater for the business needs and manage the potential business risks of the Group.

However, such systems are designed to manage, rather than to eliminate the risk of failure to achieve the Group’s corporate objectives. In pursuing these objectives, internal controls can only provide reasonable and not absolute assurance against material misstatement, operational failures and fraudulent activities.

The Board is assisted by the Management to implement approved policies and procedures on risk and control. Management identifies

and evaluates the risks faced by the Group and designs, implements and monitors an appropriate system of internal controls in line with policies approved by the Board.

KEY FEATURE OF THE GROUP’S INTERNAL CONTROL SYSTEM

Key elements of the Group’s internal control system that have been established to facilitate the proper conduct of the Group’s businesses are described below.

- Control Environment

Organisation Structure & Authorisation Procedures

The Group maintains a formal ` structure with well-defined delegation of responsibilities and accountability. It sets out the roles and responsibilities, appropriate authority limits, review and approval procedures in order to enhance the internal control system of the Company’s various operations. Key functions such as finance, tax, treasury, corporate, legal matters and contract awarding are controlled centrally.

Monitoring and Reporting Procedures

The Executive Chairman / Executive Director meets on a regular basis with all divisional heads to consider the Group’s financial performance, business developments, management and corporate issues.

The Divisional Heads and Business Unit Heads are responsible for the Standard Operating Procedures which include policies and procedures are continuously reviewed and update if required.

The Divisional Heads and Business Unit Heads are responsible for the identification and evaluation of significant risks applicable to their areas of business together with the design and operation of suitable internal controls.

Human Resource Policy

Comprehensive and rigorous guidelines on are in place, to ensure that the Company has a team of employees who are equipped with all the necessary knowledge, skills and abilities to carry out their responsibility effectively. Corporate values, which emphasize ethical behaviors, are set out in the Group’s HR Portal.

Annual Budget

For 2018 the Company has a comprehensive budgeting system established to meet the annual business plan. The annual business plan and budget are approved by the Board. Budgetary control is in place for every operations of the Company, where actual performance is closely monitored against budgets to identify and to address significant variances. - Risk Management

The Board acknowledges that all areas of the Group’s business activities involve some degree of risk. The Group is committed to ensuring that there is an effective risk management framework which allows management to manage risks within defined parameters and standards, and promotes profitability of the Group’s operations in order to enhance shareholder value.

The Board with the assistance of the Audit & Risk Management Committee continuously review the on-going process of identifying, evaluating, monitoring and managing the significant risks affecting the achievement of its business objectives throughout the financial year under review.

The risk management process involves the senior management as well as the Executive Directors through direct participation in periodic management meetings. These meetings are held to assess and monitor the Group’s risk as well as deliberate and consider the Group’s financial performance, business development, management and corporate issue.

The Board determines the Company’s level of risk tolerance and actively identifies, assess, and monitor key business risks to safeguard shareholders’ investments and company’s assets.

The Company Officer responsible for managing internal controls and legal and regulatory compliance at the company is the Head of Group Finance. - Internal Audit Function

The Group has an in-house Group Internal Audit Department to carry out its internal audit function. The internal audit function has undertaken detailed assessments of the risks and reviews of the internal control systems of CHHB’s operating environment. The areas of assessments and reviews were set out in an internal audit plan which has been approved by the Audit & Risk Management Committee.

The Group Internal Audit Department reports directly to the Audit & Risk Management Committee. Periodic testing of the effectiveness and efficiency of the internal control procedures and processes are conducted to ensure that the system is viable and robust. For 2018, all the internal audits were performed by the in-house Group Internal Audit Department. Arising from these assessments and reviews, the Group Internal Audit Department presented their reports to the Audit & Risk Management Committee on their findings, recommendations for improvements and the response from management for the Committee’s deliberation and consideration.

The internal audit function performs internal audits with strict adherence to the Professional Practices Framework of The Institute of Internal Auditors, USA (“IIA”) and conformance with the IIA’s International Standards for The Professional Practice of Internal Auditing (“Standards”) in meeting the responsibilities of internal auditors and the internal audit activity.

The responsibilities of IAD include developing the annual audit plan execution and reporting the audit results for the Group. For such purposes, the IAD:- Prepared a detailed Annual Audit Plan for submission to the ARMC for approval,

- Carried out activities to conduct the audits in accordance with the audit plan,

- Shared its findings with the auditee upon completion of each audit, and

- Submitted quarterly audit reports to the ARMC.

A summary of internal audit activities that were undertaken during the financial year ended 31 December 2018 is as follows:- A review on the Sales and Purchase agreement signed and to ensure S&P are properly reported and accurately reflected in the books;

- A review on the progress billings, maintenance billings & billings are promptly billed and accurately reflected in the books;

- A review on the debtors and the collection status;

- Official Receipts issued for monies collected/received and that the Official Receipts are eventually matched with the monies banked-in;

- to ensure that all Official Receipts are sequentially pre-numbered and number tracked for completeness;

- Review on the tendering process and the selection of contractor & Consultant;

- To ensure that cash collected is banked-in in to the HDA account promptly;

- A review on the payment and to ensure that all payments were properly approved before the payment being made;

- To review on the sales and marketing activities;

- To ascertain the memberships sold are properly recorded, reported and accurately reflected in the financial statements;

- To ascertain the yearly re-joining fees billed are properly recorded, reported and accurately reflected in the financial statements;

- To ensure that all income can be accounted for and action is taken on any outstanding income;

- Cash handling, including payments and compliance with authority limits;

- To determine that Company procedures and policies regarding revenue recording and reporting are carried out in accordance with current requirements;

- To ensure that controls and procedures in use are efficient, effective and economical.

- This update covers risk and governance of various areas with the aim to provide an independent and objective assurance to

improve and add value to CHHB's Property division activities.

- Information and Communication

Information critical to the achievement of the Company’s business objectives are communicated through established reporting lines across the Company. This is to ensure that matters that require the Board and Senior Management’s attention are highlighted for review, deliberation and decision on a timely basis.

A whistleblowing policy has been established together with the detailed processes of the policy. The policy is made known to all employees on the Group’s website, with a dedicated channel being formed where whistleblowers may direct their grouses and complaints directly to the – Chairman of the ARMC. - Review & Monitoring Process

Regular management meetings are held to discuss and monitor the Group’s operations and performance, including meetings to discuss deviation of results against performance targets, with significant variances explained for and corrective management action formulated, where necessary. In addition to the above, schedule and ad-hoc meetings are held at operational and management levels to identify, discuss and resolve business and operational issues as and when necessary.

CONCLUSION

The Group’s system of internal controls does not apply to associate companies, which the Group does not have full management control.

The Board is of the view that the system of internal controls was generally satisfactory. There were no material losses incurred during the financial year as a result of weaknesses in the system of internal controls that would require disclosure in the annual report.

Nevertheless, the Group will continue to take measures to strengthen the internal control environment.

This statement is made in accordance with the Board’s resolution dated 12 April 2019.